Holistic Retirement Planning Services

Customized, strategic, comprehensive, and proactive retirement planning for pre-retirees, retirees, professionals, and business owners.

Your Financial Future

is in Our Hands

At The Northeastern Group, we believe the best investment you can make in your future is to invest in yourself today – be it in your knowledge, your health, or your financial well-being! While we can’t help you with all areas of your life, we can help you invest in your financial and retirement future by:

- Creating a guaranteed* retirement income stream you can’t outlive.

- Protecting your nest egg from risks like inflation, legislation, taxes, and stock market fluctuations.

- Making sure your accounts are coordinated and aligned with your objectives, risk tolerance, and time horizon.

- Preparing for the possibility of a long-term care event.

- Helping create a legacy for loved ones and/or a charity.

- Taking a holistic, customizable approach to your financial planning.

- Analyzing sequence-of-return risk to help mitigate and reduce the risk of setbacks during your retirement distribution phase.

- Partnering with CPAs to help ensure the utilization of tax-efficient planning strategies.

- Providing access to our suite of Virtual Family Office experts.

*Guarantees, including optional benefits, are backed by the claims-paying ability of the issuer, and may contain limitations, including surrender charges, which may affect policy values.

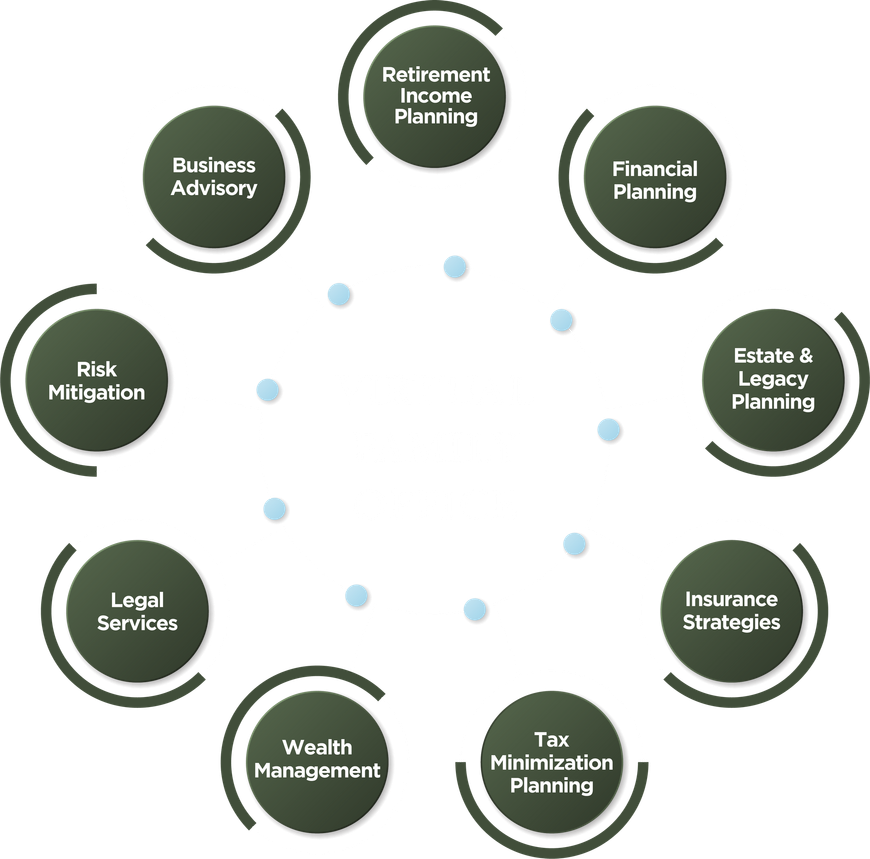

Virtual Family Office with Tailored Strategies for

Your Unique Financial Future

Our firm offers a network of connections paired with a variety of mix-and-match services that are customized to keep you in-the-know about your financial future. We act as a fiduciary on your behalf, always committed to doing what is in the client’s best interests.

We are not beholden to any specific product or carrier, only you – our valued client. Our organization boasts more than 30 years of experience. We also maintain partner relationships with attorneys, CPAs, investment bankers, and a host of other professionals, as part of what we refer to as our Virtual Family Office. Together, we can provide our clients with a holistic menu of services.

How to Rock Your Old 401(k) & Avoid Surprise Tax Bills

As a taxpayer and saver, you’ve earned the right to see your savings grow in the most tax-efficient manner possible. Your biggest mistake? Doing nothing at all. Let’s write and rewrite until your retirement income is in perfect harmony, allowing you to rock on!

The Steps to Holistic and Proactive Planning

At the Northeastern Group, our process consists of six steps that can help you design a customized retirement plan that you are not only satisfied with, but can look forward to with confidence.

Introduction – Meet and get to know each other.

Analysis – Identify the strengths and weaknesses of your financial situation and the obstacles in your way.

Goals – Clarify your desired results.

Options – Explore strategies to help reach your goals.

Strategy – Choose and implement strategies

Review – Conduct periodic monitoring and make timely adjustments.